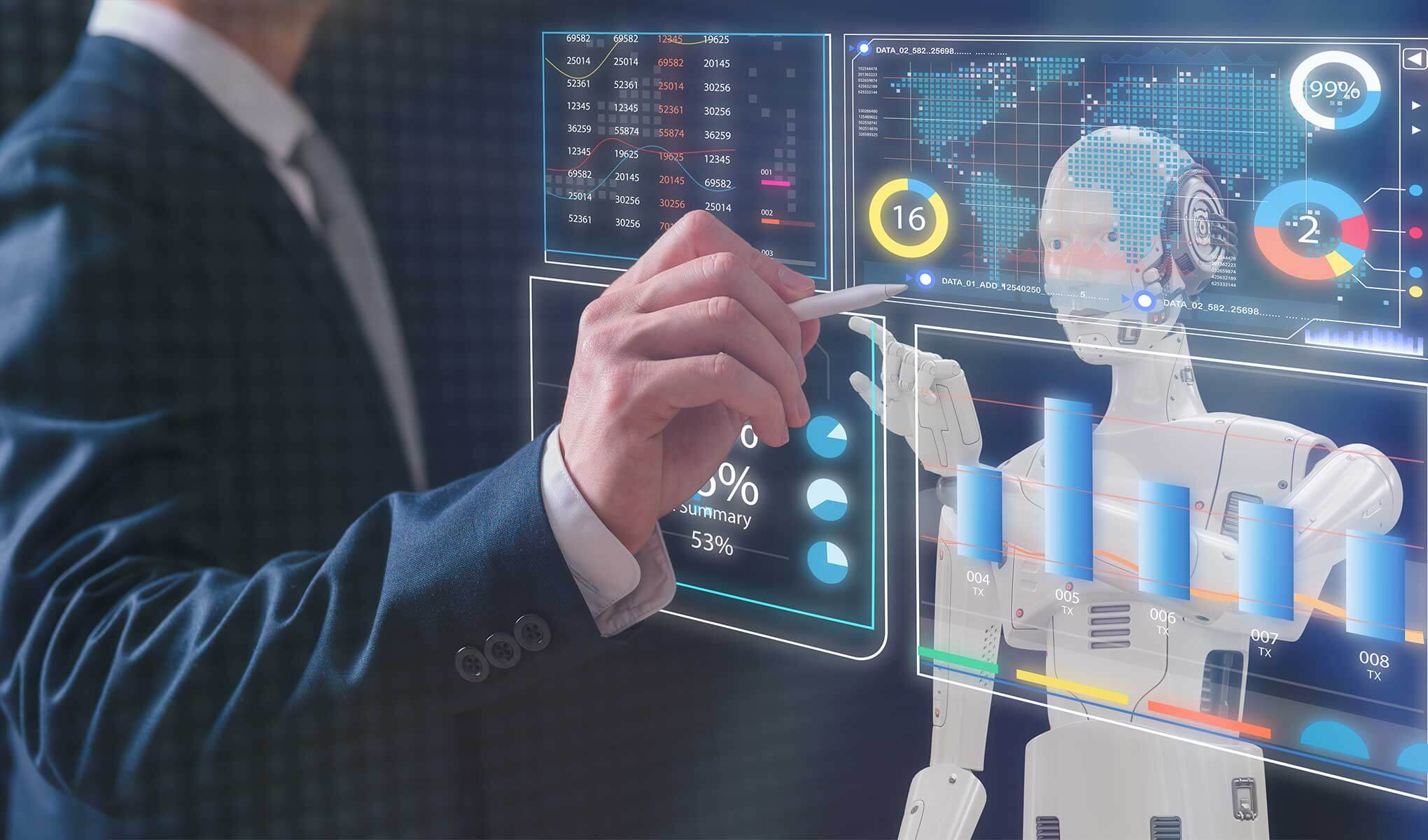

In the ever-evolving world of finance, pace and precision have become the cornerstones of successful buying and selling. As markets reply right away to economic indicators, information occasions, and global sentiment, conventional human-led evaluation is achieving its limits. In 2025, the brink no longer belongs to the fastest-questioning dealer, however to the best algorithm. Across global exchanges, AI buying and selling systems are actually always surpassing human overall performance in real-time marketplace analysis, ushering in a brand new technology of clever, automated making an investment.

Once seen as experimental, AI trading has become a core strategy for hedge funds, asset managers, and even everyday investors—thanks to the rise of powerful tools accessible via any modern AI trading platform.

The Speed Gap: Why Human Analysis Is Falling Behind

Financial markets generate terabytes of information every 2nd—from rate moves and trading volumes to economic reviews, social media sentiment, and geopolitical information. For human investors and analysts, the challenge isn't simply processing this facts, but doing so rapid sufficient to act on it before the marketplace movements.

AI systems, powered by way of device getting to know and natural language processing (NLP), close this hole. They:

- Analyze huge, multi-supply data sets in milliseconds

- Recognize hidden styles that might be invisible to people

- React right away to activities like hobby rate changes or income releases

- Continuously enhance via real-time learning algorithms

This actual-time capability gives AI a profound advantage, especially all through high-volatility durations wherein markets shift rapidly and decisively.

How AI Trading Systems Work

Modern AI trading systems are constructed on a combination of center technologies:

1. Data Aggregation & Cleansing

AI systems accumulate information from monetary APIs, information feeds, order books, and social media, cleansing and structuring it for fast evaluation.

2. Predictive Analytics

Using historical records and real-time inputs, AI fashions forecast asset prices, trend directions, and probability-weighted situations.

3. Sentiment Analysis

Through NLP, AI understands the tone of news articles, social media posts, and earnings calls, turning qualitative records into quantitative signs.

4. Strategy Execution

AI buying and selling systems set up these insights via computerized strategies—shopping for, promoting, or hedging positions across a couple of markets, all without human intervention.

These procedures take place across the clock, ensuring non-stop engagement with the marketplace at every crucial second.

Surpassing Human Traders: The Evidence

Numerous studies and actual-global examples now show that AI buying and selling structures are outperforming human buyers, particularly in areas in which velocity and data processing are essential:

- Intraday buying and selling: AI reacts to micro-trends and liquidity shifts some distance quicker than guide traders.

- High-frequency trading (HFT): AI executes thousands of orders per 2d, managing spreads and arbitrage possibilities.

- Risk control: AI can dynamically alter publicity based on volatility and macroeconomic indicators—faster and extra precisely than traditional fashions.

- Market neutrality: AI can maintain balanced portfolios that reduce publicity to directional marketplace actions, some thing hard to screen manually.

Even skilled traders at the moment are counting on AI tools to enhance their decision-making or automate components in their workflow thru included AI trading systems.

The Rise of the AI Trading Platform

As AI capabilities mature, the environment of tools to be had to traders has expanded. Today’s great AI trading systems are designed no longer only for institutional gamers, but also for independent and retail traders. They offer:

- Pre-constructed AI techniques with historical overall performance information

- Custom approach builders the usage of drag-and-drop logic or rule-primarily based inputs

- Real-time indicators and adaptive fashions that study from ongoing overall performance

- Backtesting tools to simulate AI-driven techniques underneath various marketplace situations

- Seamless integration with brokers for computerized execution

These systems are leveling the gambling discipline, allowing individual investors to get right of entry to hedge-fund-level sophistication—without writing a unmarried line of code.

Real-Time Use Cases in 2025

AI buying and selling systems at the moment are getting used across asset lessons and marketplace types. Here are a few real-world examples:

- Cryptocurrency markets: AI tracks worldwide sentiment, on-chain records, and technical indicators to trade virtual property 24/7 with minimal downtime.

- The Forex market markets: AI analyzes geopolitical information and significant bank coverage shifts to regulate currency positions in real time.

- Equity markets: AI models predict income beats or misses the use of alt-records (like internet site visitors or hiring styles) and vicinity trades for this reason.

- Commodities: AI scans satellite imagery, climate records, and delivery routes to anticipate deliver-demand imbalances in oil, grain, or metals.

These systems function with a stage of accuracy, velocity, and discipline that human investors certainly cannot mirror.

The Human-AI Partnership

Despite these benefits, AI isn't replacing traders—it’s enhancing them. Many specialists now depend on AI buying and selling structures to handle real-time tracking, automate repetitive duties, or validate change thoughts with statistics-pushed support.

This partnership permits investors to:

- Focus on strategic decision-making and chance oversight

- Spend greater time on long-time period evaluation and less on tactical execution

- Reduce emotional bias through counting on algorithmic subject

- Scale their operations by means of managing more than one strategies and markets simultaneously

The destiny of buying and selling isn't always human vs. Device—it’s human with device.

Challenges and Considerations

While AI trading structures provide tremendous electricity, they arrive with caveats:

- Model transparency: Some systems act as black containers, making it tough to recognize why a choice become made.

- Overfitting: Poorly designed models may work properly in backtests however fail in stay situations.

- Data nice: AI fashions are simplest as excellent as the records they study from—terrible information means awful choices.

- Market effect: If too many structures act on the equal signals, it is able to create flash actions or increased volatility.

Leading AI buying and selling platforms are addressing those issues thru explainability gear, actual-time diagnostics, and human-in-the-loop controls.

A New Standard in Market Analysis

The era of manual-handiest buying and selling is finishing. As markets grow greater complex and information-rich, AI trading structures provide unequalled precision, responsiveness, and scale. For the ones looking to stay aggressive, AI is no longer non-compulsory—it’s crucial.

Whether you’re handling a portfolio, day buying and selling, or building lengthy-term wealth, using a complicated AI trading platform might be the smartest improve you are making in 2025. The machines aren't simply catching up—they’re leading the way.

AI trading platform GPT Trading trading technology Artificial Intelligence AI in Business AI in Finance AI in Healthcare Quantum Computing AI Automation AI Trading Online Trading Quantum Finance